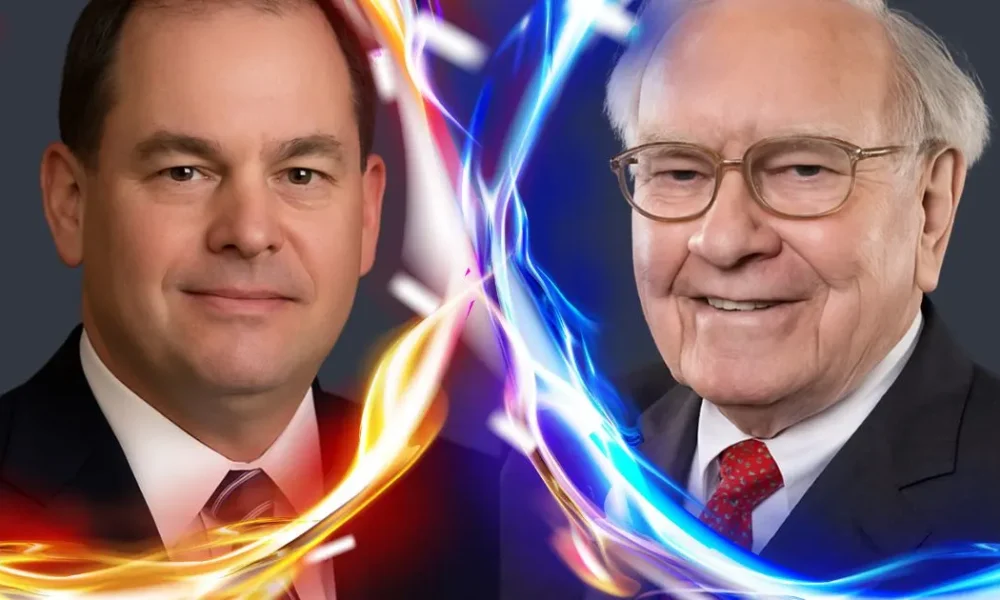

When you think of Berkshire Hathaway, the first name that comes to mind is Warren Buffett. He’s not just one of the most successful investors in history – he’s also one of the most recognised names in the financial world. But with age catching up – Warren Buffett is now 94 years old – the spotlight is slowly shifting to his successor: Greg Abel.

If you’ve never heard of Gregory Abel, you’re not alone. He’s kept a relatively low profile for someone next in line to lead one of the most powerful holding companies in the world. But don’t let the quiet demeanour fool you. Greg Abel has played a crucial role in Berkshire Hathaway’s operations for years, and by Buffett’s own admission, he’s the right man for the job.

Who is Greg Abel?

Gregory Abel, a Canadian businessman, currently serves as Vice Chairman of Berkshire Hathaway’s non-insurance operations. He’s been with the company since 2000, steadily rising through the ranks after Berkshire acquired MidAmerican Energy, which later became Berkshire Hathaway Energy. Abel was CEO of the energy division for over a decade, showing a sharp eye for managing businesses, cutting costs, and scaling operations.

His track record speaks volumes. Under his leadership, Berkshire Hathaway Energy grew into a powerhouse in renewable energy, with major investments in wind and solar. Abel’s management style and ability to oversee multiple companies without interfering too much is something Buffett himself respects deeply.

Why Greg Abel? Why Not Someone Else?

The big question for years was: who would take over after Warren Buffett? Names floated around, but Buffett settled the speculation during the 2021 annual shareholders meeting by saying it out loud – if something were to happen to him, Greg Abel would be in charge.

What’s interesting is how little drama there was around the decision. That’s classic Buffett. He doesn’t go for flash or noise. He goes for consistency, trust, and business acumen. And Greg Abel ticks every box.

Handpicked For You: RTX Stock’s Earnings Paradox: Here’s What Investors Need to Know

Warren Buffett’s Age and Net Worth

There’s no doubt that Warren Buffett’s time at the helm of Berkshire Hathaway is winding down. As of now, Buffett is 94 years old. But age hasn’t slowed him down mentally – he still reads for hours each day, keeping tabs on the market and staying engaged with investors.

Warren Buffett’s net worth continues to be a subject of fascination. As of 2025, his estimated net worth is around $127 billion, making him one of the wealthiest individuals in the world. Despite his immense wealth, Buffett is known for his frugal lifestyle and his massive philanthropic commitments through the Giving Pledge.

Greg Abel’s Net Worth and Future

With more eyes turning to him, people naturally want to know about Greg Abel’s net worth too. Estimates place it at around $500 million. While it’s a far cry from Buffett’s billions, it’s still a reflection of his long-standing role in leading major operations within Berkshire.

What’s notable is that Abel owns a roughly $870 million stake in Berkshire Hathaway Energy – a deal that makes it very clear he has skin in the game. This is someone invested in the company’s long-term future, not just a placeholder CEO.

From Omaha to the Future

Warren Buffett, often nicknamed the “Oracle of Omaha,” has built a financial empire based on long-term thinking, trust, and careful investments. Berkshire Hathaway owns companies across various sectors – from insurance and utilities to railroads, real estate, and food brands like Dairy Queen.

Now, as the next chapter begins, Greg Abel is expected to maintain this long-term approach. He’s not a radical thinker or a headline chaser. He understands what Buffett built, and more importantly, he respects it.

The transition won’t be about reinventing the wheel. It’ll be about keeping the flywheel turning. That’s something Abel has done exceptionally well so far.

What This Means for Investors

For investors watching this transition, there’s a sense of reassurance. Buffett has never left things to chance. Appointing Greg Abel well in advance and making it public wasn’t just a formality – it was a message. Berkshire Hathaway will remain in steady hands.

Buffett has always said he bets on people. With Greg Abel, he’s made one of the most important bets of his lifetime.

FAQs

Who is Greg Abel?

Greg Abel is the Vice Chairman of Berkshire Hathaway’s non-insurance businesses and the successor chosen by Warren Buffett to lead the company in the future.

How old is Warren Buffett in 2025?

Warren Buffett is 94 years old in 2025.

What is Warren Buffett’s net worth?

As of 2025, Warren Buffett’s net worth is estimated to be around $127 billion.

What is Greg Abel’s net worth?

Greg Abel’s estimated net worth is roughly $500 million, and he also holds a significant ownership stake in Berkshire Hathaway Energy.

Is Greg Abel officially the next CEO of Berkshire Hathaway?

While there hasn’t been a formal CEO transition yet, Warren Buffett has publicly stated that Greg Abel will take over when the time comes.

You Might Also Want To Read: ETF Advantages Over Mutual Funds